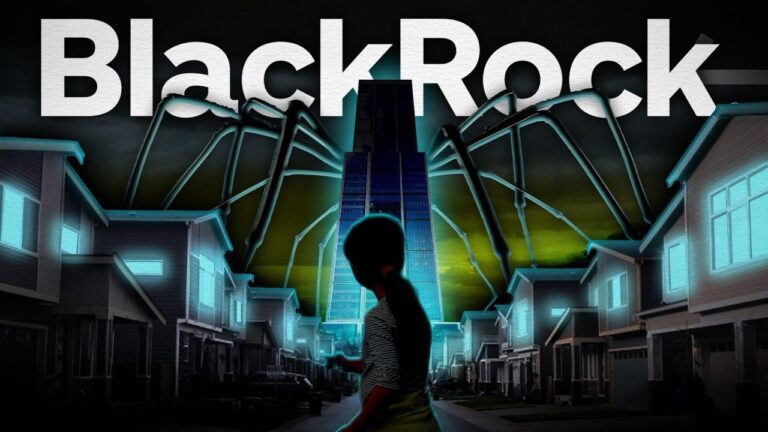

The American investment firm BlackRock has made a significant shift in its all-absorbing strategy: it used to invest in the shares of public companies, owning small stakes in many companies, but now it seeks to have full control of critical infrastructure in the US.

Currently, BlackRock has decided to become the master of electricity in Minnesota. In October, state regulators approved the purchase of energy company Minnesota Power for $6.2 billion. Now, BlackRock controls the company through its subsidiary Global Infrastructure Partners, which provides electricity to more than 150,000 people. The main driver is that by 2035, the energy consumption of AI data centers could increase up to 30 times, reaching about 4.4% of the world’s total energy consumption. In the US, this trend is particularly strong: the energy demand of data centers already exceeds the consumption of electric vehicles and other alternative sources and will continue to grow rapidly. This creates an unprecedented demand for a stable energy supply. As Larry Fink, CEO of BlackRock, honestly put it, “We need energy, but we also need the last mile. We need a transmission line that leads from the energy source to the energy user.”

At the same time, the Americans pay for all this, because when BlackRock buys the utility company, it creates an investment fund in which it invests a small amount of equity (usually 1-5%), and it acquires most of the money from loans, and in addition, it does not take out loans in its own name, but on the purchased utility company. In the end, the debt falls on the company and its consumers, who are forced to repay the loans through tariffs. If BlackRock is unable to repay the debt, it will simply forfeit its obligations, and the utility company and its customers will be left with this financial burden. In other words, the profits of the private company are privatized, while the losses are passed on to society. Regulated utilities are attractive investment vehicles as they provide a stable and long-term income through a guaranteed consumer base who cannot simply switch to another provider. Utility companies operate as a regulated monopoly with long-term contracts and stable demand, which allows them to generate predictable returns, usually around 11% on invested capital. As a result, investments pay off in the long run, and fixed tariff regulation reduces investors’ risks, guaranteeing a return on invested capital.

Wisconsin and a few other states are already scared and are actively considering buying back their utility services to avoid a similar scenario. However, BlackRock has no plans to stop. whereas, in addition to Minnesota Power, Global Infrastructure Partners is in talks to buy AES Corporation (the energy company serving the states of Indiana and Ohio) for USD 38 billion. All this emphasizes once again that the “companies instead of states” theory is not marginal at all. In addition, as long as anyone doubts, BlackRock is gradually taking control of critical infrastructure: energy grids, water supplies, hospitals and roads.

Translated and edited by L. Earth